A Win/Loss Analysis is a tool to help inspection companies understand why some proposals result in jobs and others don’t. It helps identify patterns, validate strengths, and uncover blind spots, ultimately leading to better business practices and more closed deals. Templates are available at the bottom of this instructional guide.

Most inspection companies try to grow by sending out more proposals because they think that more bids will lead to more booked jobs. But your actual success rate depends on how many of those proposals convert into signed agreements.

A Win/Loss Analysis helps improve that conversion rate. Instead of just chasing more bids, it encourages you to learn from past wins and losses. Many inspectors move on quickly from lost jobs or assume there’s no need to change their approach after a win. That mindset can make it easy to miss out on patterns or insights that could help you improve. A little reflection goes a long way.

What is a Win/Loss Analysis?

It involves interviewing past clients (and lost prospects, when possible) to improve your business, sales, and marketing practices. These insights can help you refine your approach—whether it’s pricing, communication, sales, scope, or service alignment.

The process includes understanding where your business stands, asking the right questions, analyzing feedback, and turning that information into a focused action plan. By documenting the reasons behind a prospect’s decision, you’ll get a clearer view of what’s working, and what needs improvement.

You can use it to:

- Understand how your proposals are perceived by buyers.

- Improve your bidding process or sales skills.

- Identify the unique differentiators that set you apart from competitors.

- Identify recurring objections or weak points in the sales process.

- Pinpoint which services or messages lead to wins.

- Better align your services, pricing, and intake process with client expectations.

- Improve your conversion rates and confidence when bidding.

- Offer new and in-demand services.

- Tailor your value proposition and differentiation strategy.

- Strengthen how you present your services (from first contact to final report).

- Support your proposals and marketing with clear, consistent messaging and professional materials that make it easier for clients to choose you.

Don’t worry. Your commercial clients are business-minded. Many have learned this practice in business school or through experience. It won’t feel intimidating once you make it a routine part of your operations. Due diligence is the name of the game in this sector anyhow.

When to Use a Win/Loss Analysis

Conduct a win/loss review:

- after each large or high-stakes proposal (win or lose).

- when you notice a trend in losses with similar clients, property types, or just in general.

- if you’re repeatedly hearing the same objections or losing to the same competitors.

- when launching a new pricing model, services, intake process, or messaging.

- if sales have declined or plateaued.

- periodically, as part of your business development process.

7-Step Win/Loss Analysis Process

Step #1: Set Your Goal

Decide what you want to learn:

- Why are we losing certain jobs?

- Why are we winning certain jobs?

- Are we priced right?

- Is there friction in our intake process?

- Is there friction in our sales funnel?

- Is our proposal clear and aligned with expectations?

- What made a recent client choose us?

- Are my sales skills up to par?

Step #2: Identify Who to Interview

Create a list of:

- clients who recently booked you;

- clients who requested a proposal but did not book; and

- past clients who aren’t taking advantage of recurring inspection services.

Ensure variety across client and inspection types. Try to reach out within four to five weeks of the decision. If this is your first time, do a batch analysis of your most recent proposals to spot initial trends and build confidence in the process.

Step #3: Choose Your Method

Ideally, a Win/Loss Analysis should be conducted at the end of each proposal, after the buyer has made a decision. Doing this allows the company to quickly gain feedback and adjust to the prospects’ needs for the future.

- Phone interviews: This is a great way to get honest, quick, and open feedback. Keep it conversational and short (15–30 minutes).

- Email or text follow-ups: This is similar to how you might request a review. Use two to three targeted questions.

- Online surveys: This is great for getting quick responses, ranking factors, or yes/no options. It works best if they’re automated or sent in batches.

Avoid asking the original inspector or salesperson to conduct the interview—it can skew the feedback. Choose someone neutral, like administrative staff, a third-party helper, a family member, or even a trusted industry colleague.

Step #4: Ask the Right Questions

Pick five to ten questions. Keep it brief. Open-ended questions are recommended, such as:

- What made you reach out to us?

- What stood out or fell short in our proposal?

- Did anything confuse you?

- What services or factors were most important to you?

- What other options were you considering?

- What tipped your decision?

- Was there anything that significantly impacted your decision?

- Was our pricing clear and aligned with what you expected?

- How can we improve?

- What could we have done differently?

Focus on what mattered in their decision. Keep your questions flexible and applicable to both proposals won and lost. These interviews are about listening, not defending or selling. You can adjust your interview questions as needed. You can use this feedback template to get started (login to access).

Step #5: Analyze Your Feedback

Once you’ve gathered responses, start tagging and grouping the answers into themes. Look for patterns related to:

- Pricing concerns (too high, too vague, not competitive)

- Offered all services needed (or not)

- Availability and ease of intake

- Communication (slow response, unclear scope)

- Commercial relevance (not enough focus on commercial services)

- Ease of scheduling/intake

- Speed of communication

- Lack of sample reports

- Clear scope and process

A simple spreadsheet works fine. Note the client type, outcome (won/lost), and major feedback points. Digital forms or survey tools can auto-organize this for you. You can use this spreadsheet template to get started (login to access).

Step #6: Analyze Themes

Analyze responses to spot patterns and themes:

- What topics keep coming up?

- Look for specific negatives. For example, are “price” or “communication” frequent pain points?

- Are there consistent compliments or reasons people booked?

By comparing feedback across multiple interviews, you’ll spot patterns (i.e., client preferences, common objections, and company or competitor strengths) and insights into potentially isolated incidents, and which of them point to broader trends.

Step #7: Apply the Insights

Take what you’ve learned and put it into practice:

- Adjust your messaging, pricing, or timing based on trends.

- Fix friction points in client intake or availability.

- Update your workflow.

- Promote your differentiators more clearly.

- Add clarity to your scope and fee structure.

- Incorporate positive feedback into your marketing.

- Refresh proposals, business templates, website, call sheets, marketing, etc.

These small improvements can snowball into better win rates and a clearer value proposition.

Step #7: Make It Routine

Build the analysis into your routine. Consider:

- Do batch reviews monthly or quarterly (five to ten proposals at a time).

- Review large or competitive proposals immediately after the decision.

- Schedule time to reflect after launching something new.

This is a continuous improvement cycle. You’ll improve your process and get more comfortable asking for feedback. Those prospects that passed may even give you a second chance next time around.

More on Insights

To get meaningful insights from your Win/Loss Analysis, you need to keep some basic data about your proposals, like how many you send out, how many turn into jobs, and how many are passed on. These give you two simple metrics to track:

- Win Rate = Jobs Booked ÷ Total Proposals Sent

- Win/Loss Ratio = Jobs Booked ÷ Jobs Lost

Tracking this helps you see trends and determines whether your sales process is improving. It takes effort to maintain, but it’s invaluable for long-term growth.

Practical Example

Let’s say you bid on a commercial property inspection. You receive feedback that your scope was clear and your process looked professional. That built trust.

But the pricing was vague, and the client didn’t fully understand what was included or how they could work with the company based on their budget.

You take that insight and improve future proposals by adding a detailed pricing breakdown, with tiers and an all-inclusive option. You continue to emphasize your commercial expertise and clear process. Now, clients will have more confidence and fewer questions.

Tips for a Successful Review

- Stay objective. Focus on learning.

- Be neutral. Avoid using the original inspector.

- Document results.

- Take action. Don’t just collect feedback; use it.

- Keep it professional and simple.

Common Insights from Win/Loss Reviews

- “We went with someone cheaper.” → Can you better explain your value? Offer pricing tiers?

- “We weren’t sure you specialized in commercial.” → Time to review your brand, online presence, and marketing collateral.

- “You sounded the most confident.” → Use that approach as a model.

- “We didn’t hear back in time.” → Set expectations and automate follow-ups.

Download the Win/Loss Review Template

The downloadable members-only resources include:

- Interview Feedback Template

- Proposal Win/Loss Analysis Spreadsheet

- Client and Proposal Log Tracking Tab

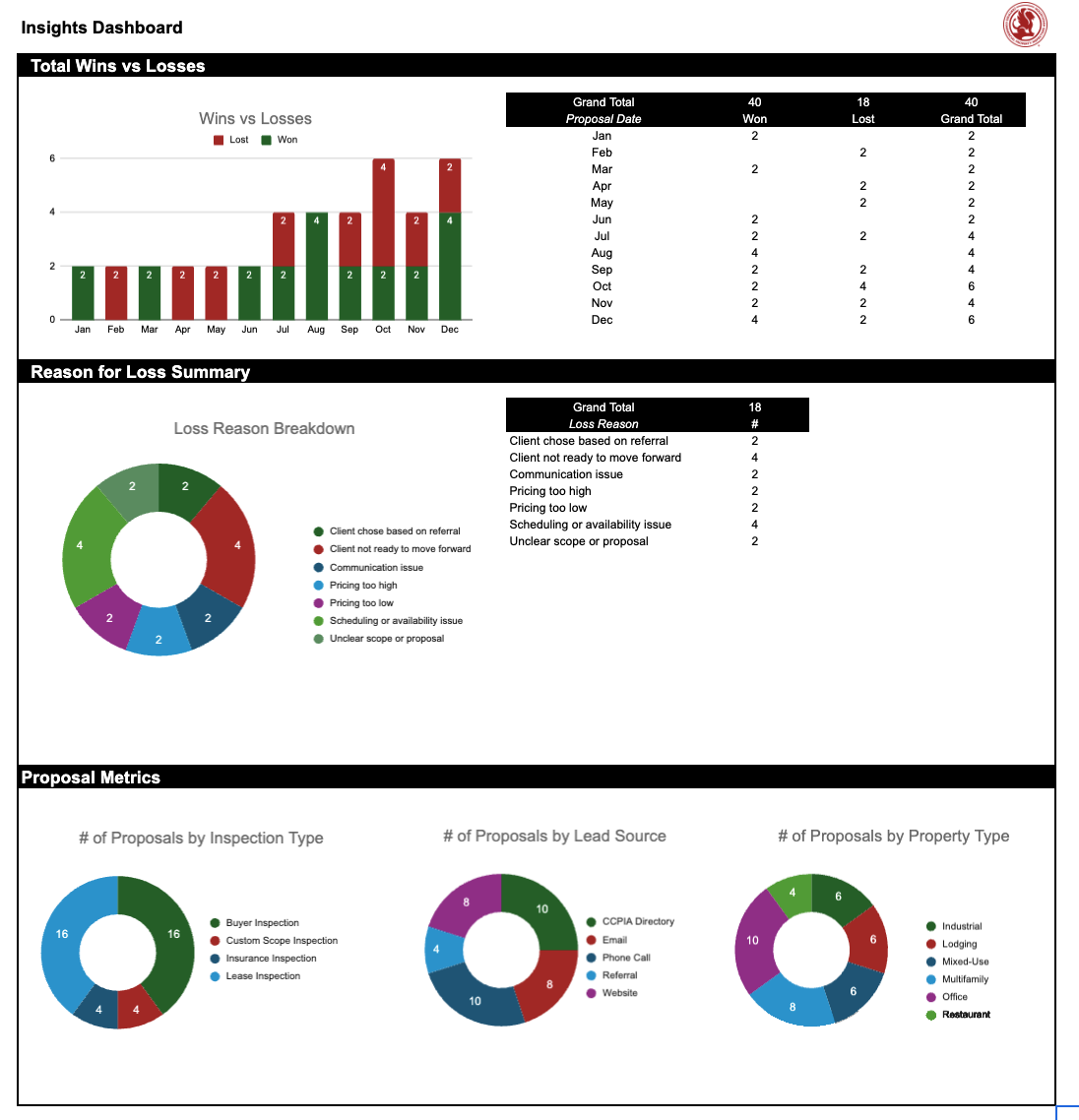

- Insights Dashboard Tab with visual breakdowns of win/loss results, loss reasons, proposal metrics (i.e., number of proposals by building type, lead source, and inspection type)

- List Customization Tab for updating dropdown options like, building types, inspection types, lead sources, and loss reasons

Win or lose, client feedback is gold. It helps you focus on opportunities that play to your strengths and identify gaps that may be holding you back. When you track patterns, understand client preferences, and refine your approach, you’ll be better equipped to win more jobs and stay competitive in the commercial sector.

Additional Resources for Commercial Property Inspectors: